In the bustling marketplace of today, small businesses must leverage every tool they can to ensure visibility and competitiveness. Press release services provide an invaluable opportunity to broadcast news, …

The allure of street food transcends borders, languages, and cultures, embodying the spirit of exploration and the joy of discovering new tastes. This universal appeal is what culinary enthusiasts …

Installing a water softener in your home can bring a multitude of benefits, from preventing scale buildup to enjoying softer skin and cleaner clothes. However, proper preparation is crucial …

Corporate events are more than just gatherings; they’re opportunities for companies to meet specific goals, like launching a product or celebrating achievements. Planning these events requires careful thought and …

In recent years, Kamagra has gained significant popularity in Croatia as an effective treatment for erectile dysfunction. Its rise can be attributed to several factors, including its affordability compared …

2015 marked a turning point for the world of web design with Google’s introduction of the “Mobile-Friendly Update.” Google would now prioritize mobile-friendly websites in their search rankings, thus …

South Carolina (SC) state has a rich history dating back to the Civil War and even earlier. But what is more important is how the economy has been growing …

The UEFA Champions League is like a super cool football tournament where the best teams from Europe come to play. This year, some teams are surprising everyone with how …

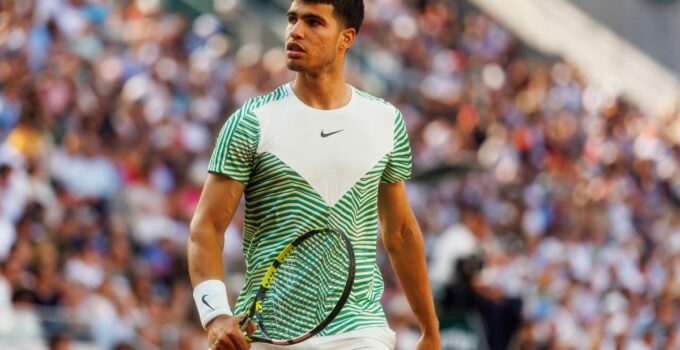

Carlos Alcaraz, the rising star of professional tennis, has his sights set on winning the prestigious Roland Garros tournament. He has already won two grand slam titles, as of …